The banking sector is highly competitive. Today’s customers demand convenience and flexibility in their financial transactions. As a result, it has become vital to establish a network of bank branches and ATMs (Automated Teller Machines) at strategic locations. We utilize GIS as a decision-making tool to help our clients locate suitable sites for establishing financial and transaction centers. This tool takes into consideration factors like accessibility, customer density of an area, lifestyle of the residents, their average earnings, spending patterns etc.

Location Analysis

Location Analysis

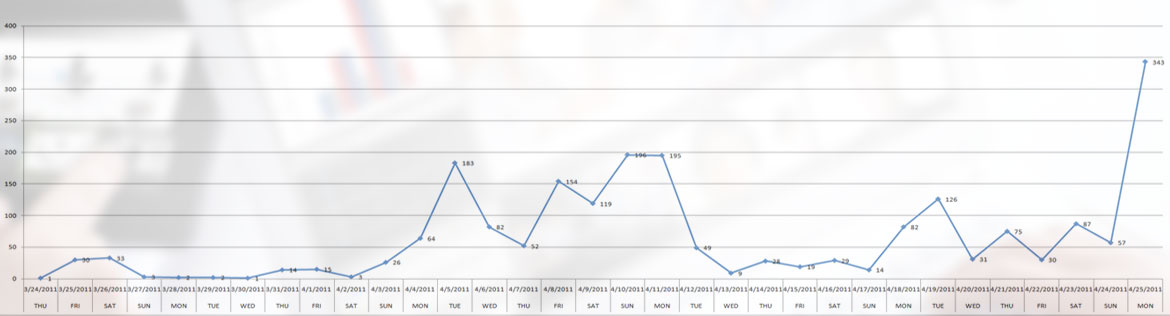

The effectiveness of branch performance analysis for banking and insurance organizations can be majorly enhanced by adding a spatial component to the process. We deliver data-driven geospatial solutions to our clients that can help them demarcate a trade area around a branch to measure customer density, identify competitors, determine products purchased by customers belonging to various economic groups, manage assets etc. Our smart web-based GIS application provides an integrated dashboard to monitor branch performance easily and facilitates easy decision-making.

Performance Monitoring

Performance Monitoring

A detailed understanding of risks is vital for businesses to gain a competitive advantage. GIS provides the ability to identify risks through correlating assets based on location. We specialize in developing systems for tracking and analyzing risk management data of banking and insurance industries. This provides enhanced insights into data to identify ways to mitigate risks and improve profitability.

Risk Management

Risk Management