Insurance Underwriters are the people who decide whether or not to accept policies for properties, such as houses, cars and offices. Typically these underwriters have limited visibility and understanding into how a new policy can increase an insurance company’s risk exposure, adversely affect overall profitability. Using the Insurance Underwriting solution, Underwriter's are now able to better understand the potential risk of a new policy: what’s the annual average loss (AAL) expected for a similar policy in the same area, how many policies already exist in the area and what hazards are nearby.

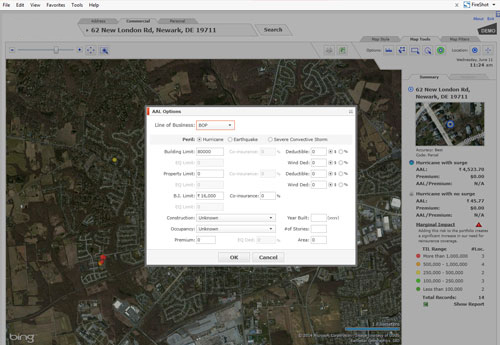

This is the main page where the insurance agent can search the policy location by address or policy number and view the summery, legend of the corresponding policy details of that location . User can customized the map view also analysis the reports using different map tool.

Here user can calculate the annual average loss of any policy. Depending upon the peril and other parameter it calculate the average loss, marginal impact and other different reports etc.

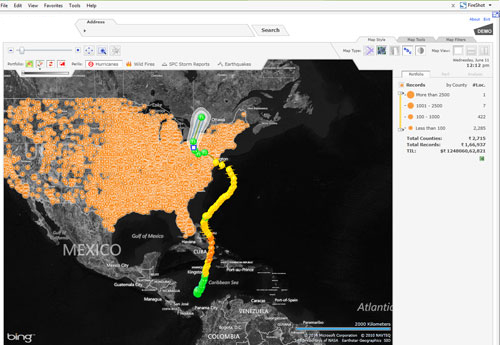

This application provide us to find out the reports of different type of perils like root of hurricanes , area of earthquakes and wild fire etc. Its helps to calculate the commercial loss of the effected areas.

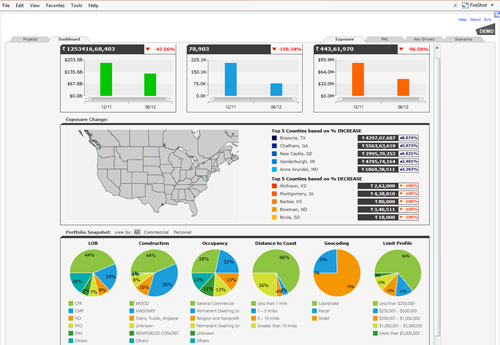

This module shows the statistics of the company , where the management can generate different type of report and handle the future risk. There are so many parameter to generate different reports.

Please Select a Country: